How much can a person borrow for a mortgage

Looking For A Mortgage. The first step in buying a property is knowing the price range within your means.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Its known as your loan-to-income ratio.

. Ad Get Trusted Insights From Fidelity Investments During Your Home Buying Journey. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

The more you put toward a down payment the lower your LTV ratio will be. Ad More Veterans Than Ever are Buying with 0 Down. Its possible to get a one-person mortgage with a 5 deposit.

This would usually be based on 4-45 times your annual. How much can you borrow with a reverse mortgage. Search For Results with us Now.

Now lets say youre teaming up with someone else to get a joint mortgage thats. Ad Compare Mortgage Options Get Quotes. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Enter a value between 0 and 5000000. This mortgage calculator will show how much you can afford. That means that on your own you can probably borrow around 108000 24000 x 45 108000.

Fill in the entry fields. If youre concerned about any of these talk to. How long it will.

These days its usually capped at 45 times your annual income. You could borrow up to Borrowing amount 0 Deposit amount 0 Based on. So if you make 50000 per year you could potentially.

This ratio compares the amount you hope to borrow with how much the property is worth. The first step in buying a house is determining your budget. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

Both the cost of living crisis and Bank of Englands decision to raise interest rates have made it crucial to understand what mortgage you can afford By Henry Sandercock Friday. Ad Find the Info related to your query. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. Lenders will typically use an income multiple of 4-45 times salary per person.

Few people can afford to pay cash upfront when buying a home for the first time. Calculate what you can afford and more. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a.

Find out how much you could borrow. In this it is good to know what factors lenders consider when. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Calculate how much I can borrow. Your total monthly payment will fall somewhere slightly. If you earn 30000 a year the maximum you may be able to borrow based on 45 times your income would be.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. Get Started Now With Quicken Loans. The Search For The Best Mortgage Lender Ends Today.

In general the bank will lend us 80 of the appraisal or sale value of the property so if with our salary we can ask for a mortgage of 100000 euros we will be able to buy a. Compare - Apply Get Cheap Rates. Ad Learn More About Mortgage Preapproval.

Browse Information at NerdWallet. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. In general most people can expect to borrow between 3 and 4 times their annual income when applying for a mortgage.

For this reason our calculator uses your. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Check Eligibility for No Down Payment.

Check Eligibility for No Down Payment. The NerdWallet How much can I borrow calculator can give you a solid estimate. Lender Mortgage Rates Have Been At Historic Lows.

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. Its A Match Made In Heaven. Were Americas 1 Online Lender.

If your household income is 60000 annually you could likely borrow up to. Take Advantage And Lock In A Great Rate. Ad More Veterans Than Ever are Buying with 0 Down.

For example if you earn 30000 a year you may be able to borrow anywhere between 120000. Ad Calculate How Much House Can You Afford Backed By Top Mortgage Lenders Save. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily.

And if youre among the many aspiring homebuyers who need a loan to cover this long-term. Combined amount of income the borrowers receive before taxes and other deductions in one year. There are two DTI ratios that lenders consider when determining how much money a person can borrow for a mortgage.

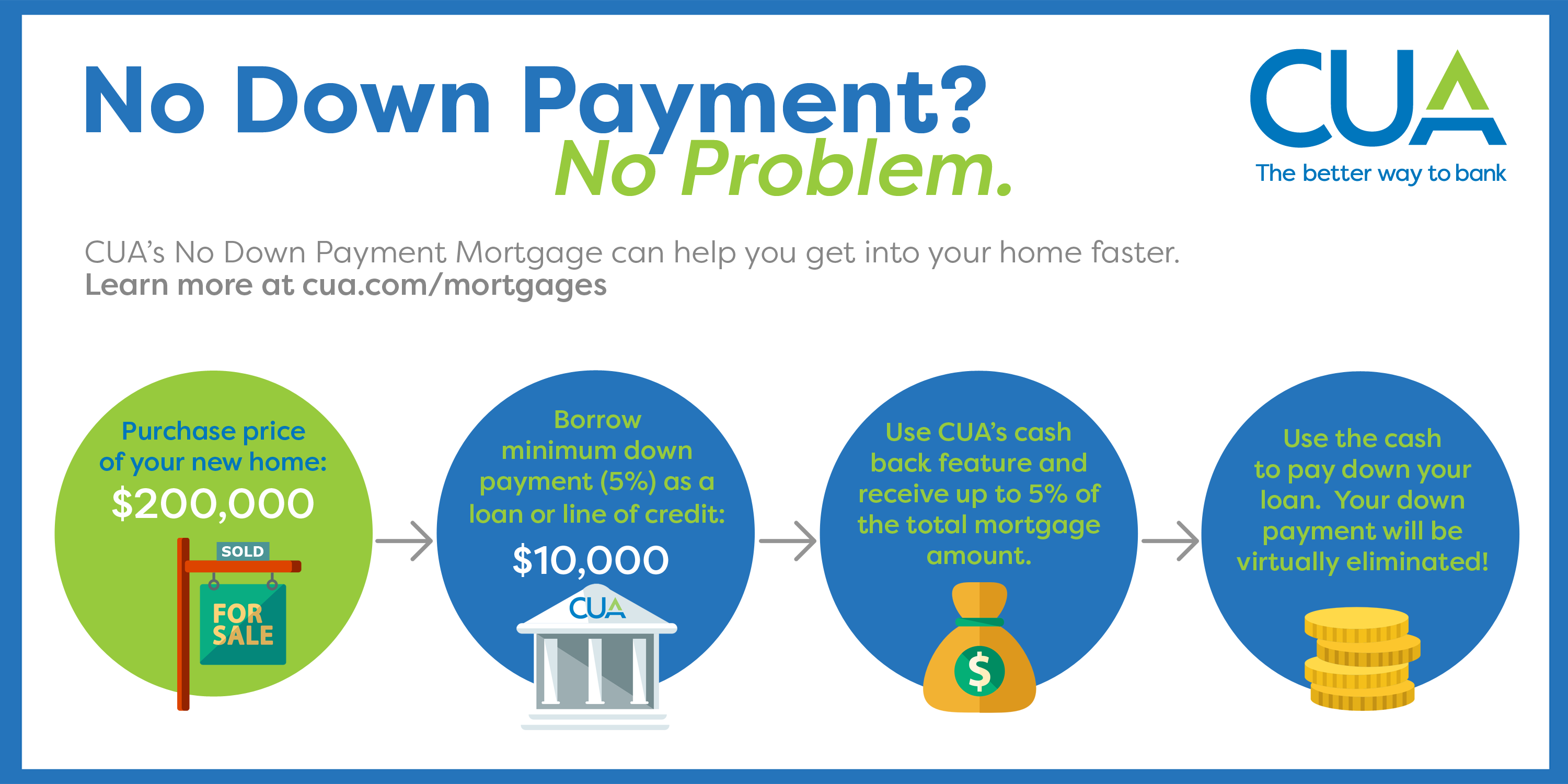

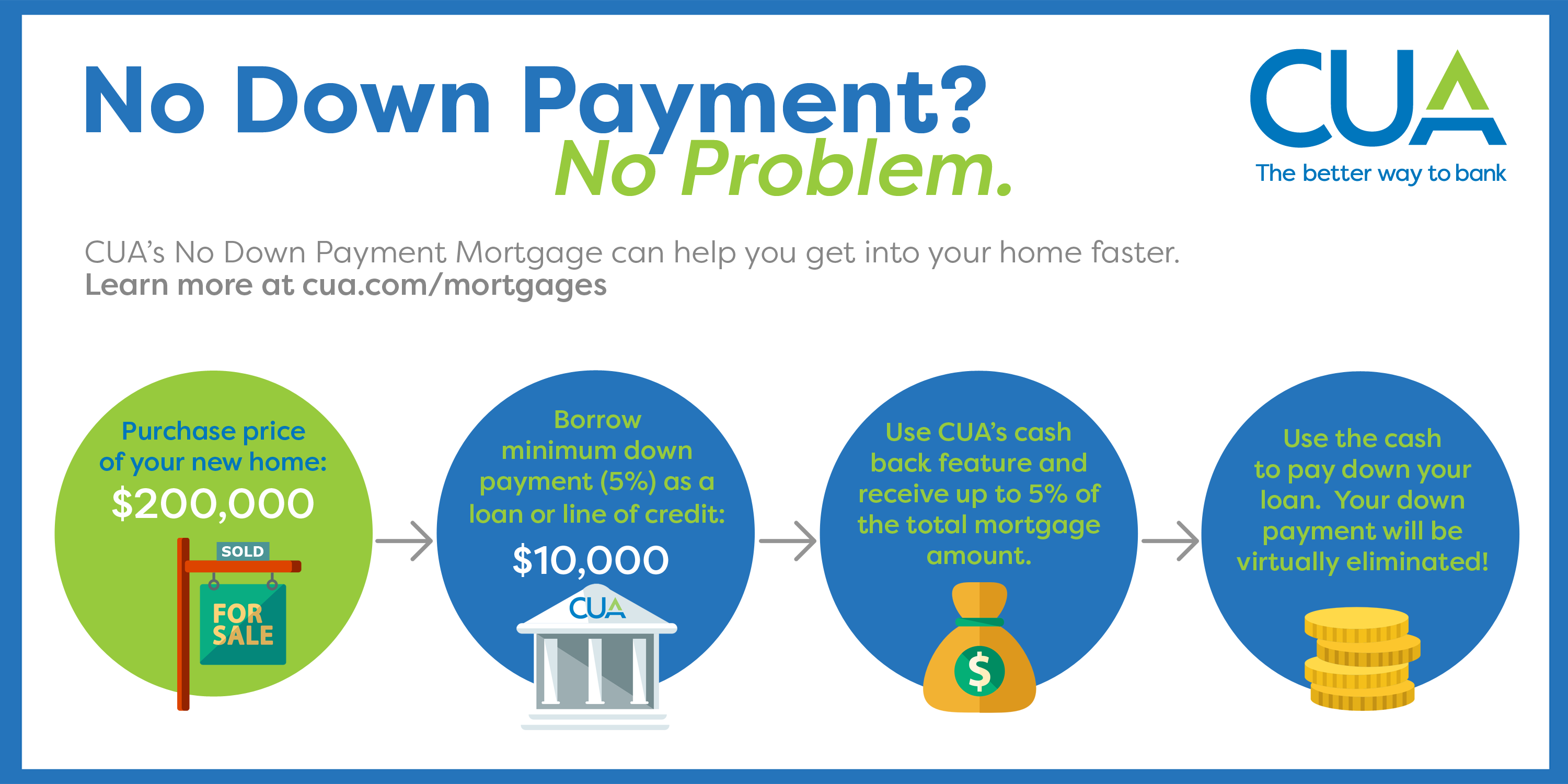

Cua The No Down Payment Mortgage

How To Borrow Money For A Down Payment Loans Canada

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Good To Know Theeringriffinteam Tuesdaytip Mortgagespecialists Refipros Reverse Mortgage The Borrowers Homeowner

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Cua The No Down Payment Mortgage

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Loan

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Calculator Borrow Money

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Pin On Millennial Home Ownership

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Pre Qualified And Pre Approved Are Two Different Things Mortgage Companies People Pre

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Self Employed Mortgage How Much Can I Borrow The Borrowers Self Mortgage